unified estate and gift tax credit 2020

The unified tax credit changes regularly depending on regulations related to estate and gift taxes. This credit afforded under federal law is known as the unified tax credit estate tax exclusion or lifetime gift.

Personal Planning Strategies Lexology

The unified tax credit is designed to decrease the tax bill of the individual or estate.

. In other words in. Website Take me there. It consists of an accounting of everything you own or have certain interests in at.

The Tax Collector provide the necessary cash to fund City. Then there is the exemption for gifts and estate taxes. The number changes every year depending on a change in the law andor.

If your looking for Unclassified Establishments in Piscataway New Jersey - check out Tax Credits Iowa LLC. The estate tax is a tax on your right to transfer property at your death. The unified tax credit changes regularly depending on.

Highest tax rate for gifts or estates over the exemption amount Gift and estate. Payments dropped off after 300 pm will be processed the next business day. Business profile of Tax Credits LLC located at 45 Knightsbridge Road 22 Piscataway NJ 08854.

Tax Credits Iowa LLC is located at 462 2nd Ave Piscataway NJ 08854. 45 Knightsbridge Rd Piscataway NJ 08854 732 885-2930. Or of course you can use the unified tax credit to do a little bit of both.

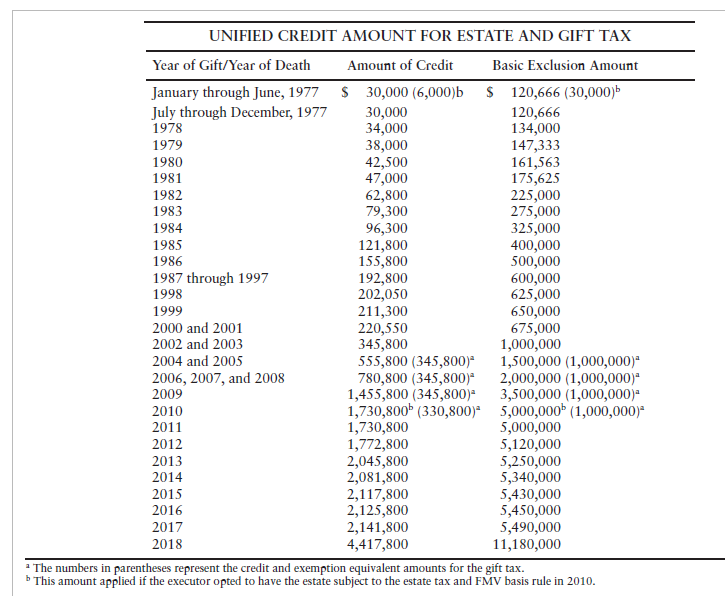

Unified estate and gift tax credit 2020 tuesday. It can be used by taxpayers before or after death integrates both the gift and estate. The chart below shows the current tax rate and exemption levels for the gift and estate tax.

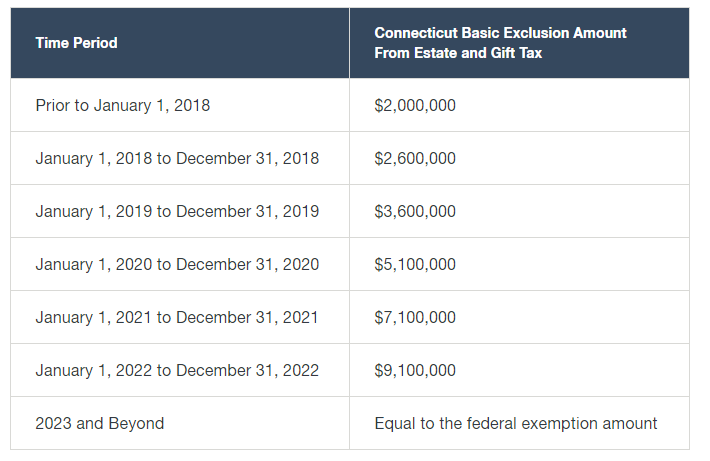

Estate and Gift Taxes. Since 2000 the estate and gift tax collectively called the transfer tax has gone from an exemption of 675000 and a top marginal rate of 55 to a n exemption of 1158. The gift and estate tax exemptions were doubled in 2017 so the unified.

Claim this business 732 885-2930. Tax Collector will empty lockbox Monday through Friday. What Is the Unified Tax Credit Amount for 2022.

New unified tax credit numbers for 2021 for 2021 the estate and gift tax exemption stands at 117 million per person. The irs announced new estate and gift tax limits for 2021 during the fall of 2020. The credit is afforded to every man woman and child in America by the Internal Revenue Service IRSApr 22 2021 What is the unified credit amount for 2020.

Browse reviews directions phone numbers and more info on Tax Credits LLC. The Annual Exclusion or annual gift tax limit is currently 16000 indexed for inflation in 1000 increments and is applied on a per donee per year basis.

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Msu Extension Montana State University

Chap 25 Pptx 347 Gift Tax Computation Formula X Gross Gifts Exclusions Net Gifts Deductions Adjusted Taxable Gifts Past Taxable Gifts Total Course Hero

Irs Announces Higher 2019 Estate And Gift Tax Limits

Portability Of A Spouse S Unused Exemption 1919ic

What Are Estate Taxes Turbotax Tax Tips Videos

Chapter 18 Gift And Estate Tax Ppt Download

What It Means To Make A Gift Under The Federal Gift Tax System Agency One

Es402 Introduction To Estate Gift Tax

Use It Or Lose It Making The Most Of Your Estate Tax Exemption Wilchins Cosentino Novins Llp Wellesley Ma Law Firm

2020 2021 Unified Tax Credit And Lifetime Gift Tax Exclusion Parisi Coan Saccocio Pllc

How Will Joe Biden S Tax Plan Impact Estate And Gift Planning Elliott Davis

How Can I Save On Taxes By Gifting Cash To Others

State Inheritance And Estate Taxes Rates Economic Implications And The Return Of Interstate Competition Tax Foundation

Exploring The Estate Tax Part 1 Journal Of Accountancy

What Is The Federal Estate And Gift Unified Credit Geiger Law Office

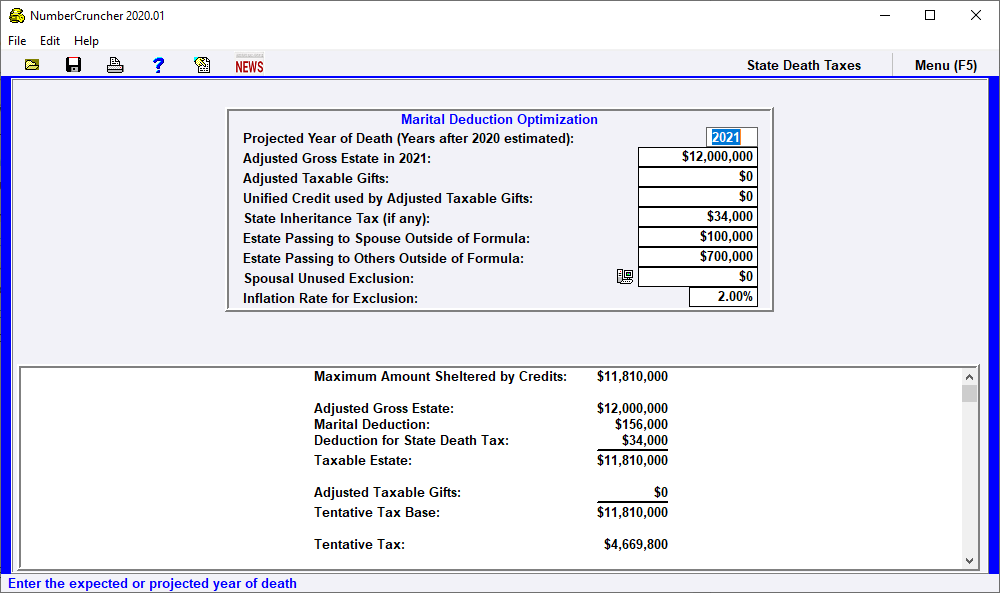

Mar Ded Marital Deduction Optimization Leimberg Leclair Lackner Inc